Refrigerated Van Leasing

Refrigerated van leasing and finance deals via HAF. As vehicle finance specialists we can provide the very best lease agreements on your next fridge van. Working alongside some of the UK’s largest suppliers of both new and used refrigerated vans, we can help source your vehicle. This combined with our specialist finance options allows us to provide the all-in-one solution.

Get in touch for a same day finance quotation by sending an enquiry form or giving us a call.

Refrigerated Van Leasing Options

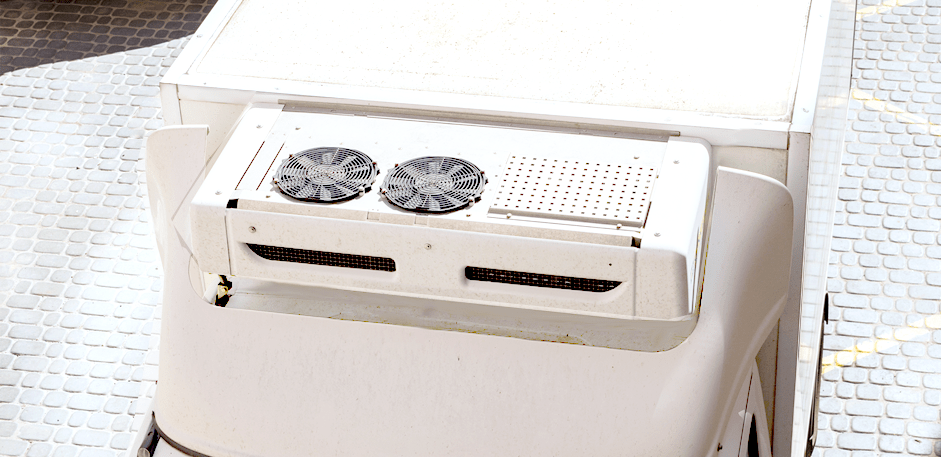

We understand that finding the best refrigerated van for your business can be difficult, this is why HAF partner with specialist suppliers that offer all types of refrigerated vans. There are four main types of refrigerated vans: Insulation-only van, semi-freezer conversion van, full-freezer conversion van and the chiller conversion van.

Still considering which van is best suited for your business? It is important to consider what temperatures you need to maintain your goods and the distances you will be travelling. Below is some information on the four types of refrigerated vans to aid your decision. For further advise and support on sourcing and financing your next vehicle, please get in touch with HAF.

Why Use HAF?

As industry leaders in the asset finance industry, we have a dedicated team that specialise in hard asset finance. Partnering alongside suppliers and providing direct finance to customers. We can provide leading rates, professional advice and connections to some of the best suppliers and manufacturers of equipment and vehicles. Saving you time and effort by delivering an all-in-one solution. Perfect for any business looking to acquire hard assets in the most affordable way possible.

The sectors we specialise in include commercial vehicles, manufacturing equipment, plant equipment, machinery, construction vehicles and agricultural machinery/vehicles.

Financing hard assets provides finance companies with good security as the assets tend to retain value for many years, even at the end of their lease. This combined with our access to a diverse portfolio of funders means we can provide you a bespoke and affordable finance option.

Key points

- We can source your vehicle

-

Offer a range of flexible

finance options - Provide industry leading rates

- Both new and used vehicles

-

Offer years of industry

experience

Benefits of Refrigerated Van Leasing & Finance

Asset finance is most commonly used to acquire hard assets. A hard asset is a tangible/physical asset with fundamental value that are normally held for the long term. Like recovery trucks they are often key to the businesses operations but are expensive in value. These are two of the key reasons why most businesses look to use a hard asset finance facility. There are also a range of benefits that come with this option:

Protect Cash Flow

Keep cash in the business and invest in areas that will produce a return on investment. Obtain the vehicle that is necessary for your business with little to no upfront cost.

Fixed Repayments

Perfect for financial planning and selecting a finance package that is affordable for your business.

No Large Upfront Cost

No need to invest large sums upfront, however this is an option if you wish to reduce monthly payments.

Quick Access

If you need a recovery truck urgently but don’t have the immediate cash available, finance allows you to obtain the asset immediately without having to wait for the cash reserves.

Access to Higher Spec Vehicles

No need to compromise on the vehicle you select. The difference in a newer or higher spec vehicle can often be a very small increase in monthly payments.

Different Types

There are four different types of refrigerated vans.

Types of Refrigerated Vans

Insulation-only Van

The insulation-only van contains a thick layer of insultation in the loading bay, usually made from around 50mm of Styrofoam and polystyrene. With no refrigeration, this type of van is most suited to businesses transporting non-perishable goods. Therefore, if you are transporting food items this van would not be advised. It is ideal for businesses wanting to maintain a consistent temperature inside the van.

Chiller Conversion Van

A chiller conversion van is an extremely popular choice due to its versatility and ability to achieve temperatures as low as 0°C, up to 8°C. It is ideal for pharmaceutical companies and those transporting chilled food to be stored at 0°C or above. Perfect conditions for transporting chilled meat and dairy products.

Semi-freezer Conversion Van

If you are wanting to transport frozen goods, then the semi-freezer conversion van is the ideal option. A thick layer of insulation around 75mm thick, the freezer unit will keep a constant temperature of around -10°C up to -15°C. Some of these semi-freezer vans also come with a defrost option which defrosts in seconds.

Full-freezer Conversion Van

This type of refrigerated van is similar to the semi-freezer but with reinforced side and rear doors it has the ability to keeps products frozen as low as -20°C. Our suppliers can also provide options that can maintain even lower temperatures, by simply adding further insulation. These vehicles also come with the ‘reverse cycle anti frost’ system, as with the semi-freezer vans this can defrost the goods in seconds.

HAF Finance

Here we have the four agreement types used for recovery truck finance and all hard assets. Here at HAF, we will guide you through all options and help you select the most suitable for your business.

Finance Options

Hire Purchase

Hire Purchase (HP) are monthly rental instalments where at the end of the term you have the option to purchase the asset outright or simply return it. Payments can be structured to align with your cash flow which could mean a small upfront payment or larger to reduce monthly payments.

Finance Lease

A finance lease is a leasing agreement which involves renting the asset over an agreed period of 1-5 years. A popular method due to the significant tax advantages. At the end of the agreement, you have four options: Hand the asset back to us at HAF, purchase the asset outright, continue paying the monthly payments or take out a new lease.

Operating Lease

An operating lease is an agreement to use and operate an asset without the transfer of ownership. Often used for high value assets, the rental is at an agreed rate and time period. The rental will not cover the full cost of the asset, therefore at the end of the agreement a residual value is offered by the funder which allows you to buy the asset minus the lease rentals paid so far.

Business Contract Hire

Business contract hire is a popular finance option used for company cars. The vehicle is leased over an agreed period from 2-5 years. At the end of the agreement, the vehicle is handed back to the finance company. A simple agreement often used for brand new vehicles, sometimes used with no upfront fee just monthly instalments.