Pickup Truck Finance

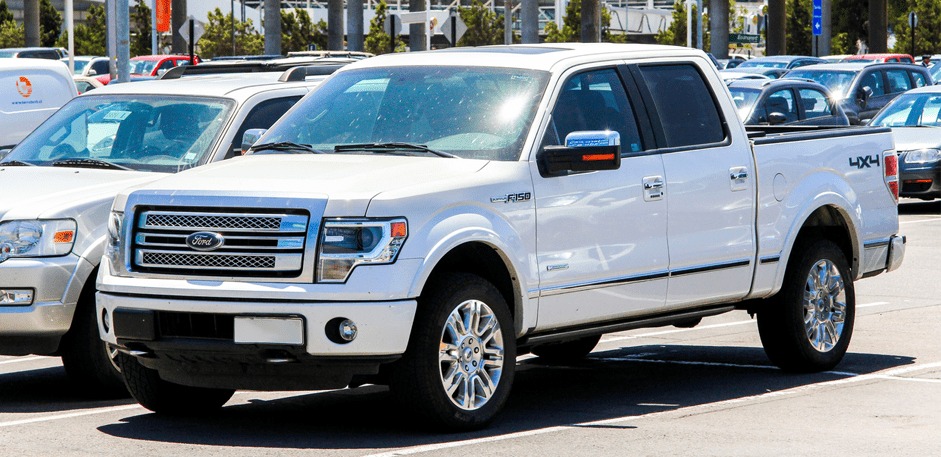

Pickup truck finance and leasing solutions brought to you by our dedicated pickup truck division. We take pride in finding your dream Pickup Truck financed into affordable monthly payments. A range of fantastic Pickup Truck finance deals available for both new and used trucks. For business or personal finance agreements please get in touch today.

Extremely cost-effective vehicles that provide fantastic tax benefits due to their commercial vehicle status. Any double -cab pickup trucks that can carry more than one tonne of payload are commercial vehicles. We have a range of flexible finance options available which can be tailored to your specific needs. Simply send through an enquiry form or give us a call for a same day quotation!

We can help you source a brand new or used pickup truck

Over the last 5 years Pickup Trucks have become extremely popular vehicles across the UK. For business users that need a practical vehicle for work that doubles as a family car on the weekends. Providing comfort, power and size the demand has risen and so has the number of options available. Attracting interest from large manufacturers such as Mercedes, Nissan, Ford, Volkswagen, Toyota, Renault and more. Each with their own range of high to low spec vehicles tailored towards different requirements. With our industry knowledge and supplier relationships, we can help find the perfect vehicle for you. This combined with our leading finance and leasing options, means you can obtain the vehicle without investing large sums of cash up front.

Check out just some of the great truck finance deals we have on offer here! This is just a selection, if you have a particular model and spec in mind then please get in touch. Our team can provide you with a same day finance quotation based on the price of the vehicle and the term length that suits you. There is no deposit required but can be used to bring the monthly payments down. Often the difference between obtaining the highest spec vehicles is just a small increase in monthly fees so there is no need to compromise.

Why Use HAF?

As industry leaders in the asset finance industry, we have a dedicated team that specialise in hard asset finance. Partnering alongside suppliers and providing direct finance to customers. We can provide leading rates, professional advice and connections to some of the best suppliers and manufacturers of equipment and vehicles. Saving you time and effort by delivering an all-in-one solution. Perfect for any business looking to acquire hard assets in the most affordable way possible.

The sectors we specialise in include commercial vehicles, manufacturing equipment, plant equipment, machinery, construction vehicles and agricultural machinery/vehicles.

Financing hard assets provides finance companies with good security as the assets tend to retain value for many years, even at the end of their lease. This combined with our access to a diverse portfolio of funders means we can provide you a bespoke and affordable finance option.

Key points

- We can source your vehicle

-

Offer a range of flexible

finance options - Provide industry leading rates

- Both new and used vehicles

-

Offer years of industry

experience

Benefits of Pickup Truck Finance

Asset finance is most commonly used to acquire hard assets. A hard asset is a tangible/physical asset with fundamental value that are normally held for the long term. Like recovery trucks they are often key to the businesses operations but are expensive in value. These are two of the key reasons why most businesses look to use a hard asset finance facility. There are also a range of benefits that come with this option:

Protect Cash Flow

Keep cash in the business and invest in areas that will produce a return on investment. Obtain the vehicle that is necessary for your business with little to no upfront cost.

Fixed Repayments

Perfect for financial planning and selecting a finance package that is affordable for your business.

No Large Upfront Cost

No need to invest large sums upfront, however this is an option if you wish to reduce monthly payments.

Quick Access

If you need a recovery truck urgently but don’t have the immediate cash available, finance allows you to obtain the asset immediately without having to wait for the cash reserves.

Access to Higher Spec Vehicles

No need to compromise on the vehicle you select. The difference in a newer or higher spec vehicle can often be a very small increase in monthly payments.

HAF Finance

Here we have the four agreement types used for recovery truck finance and all hard assets. Here at HAF, we will guide you through all options and help you select the most suitable for your business.

Finance Options

Hire Purchase

Hire Purchase (HP) are monthly rental instalments where at the end of the term you have the option to purchase the asset outright or simply return it. Payments can be structured to align with your cash flow which could mean a small upfront payment or larger to reduce monthly payments.

Finance Lease

A finance lease is a leasing agreement which involves renting the asset over an agreed period of 1-5 years. A popular method due to the significant tax advantages. At the end of the agreement, you have four options: Hand the asset back to us at HAF, purchase the asset outright, continue paying the monthly payments or take out a new lease.

Operating Lease

An operating lease is an agreement to use and operate an asset without the transfer of ownership. Often used for high value assets, the rental is at an agreed rate and time period. The rental will not cover the full cost of the asset, therefore at the end of the agreement a residual value is offered by the funder which allows you to buy the asset minus the lease rentals paid so far.

Business Contract Hire

Business contract hire is a popular finance option used for company cars. The vehicle is leased over an agreed period from 2-5 years. At the end of the agreement, the vehicle is handed back to the finance company. A simple agreement often used for brand new vehicles, sometimes used with no upfront fee just monthly instalments.