Biomass Boiler Finance

HAF provide specialist biomass boiler finance solutions for commercial and industrial biomass systems. Our renewable energy finance division can assist with a bespoke finance agreement for your business. With a range of finance options available, we can advise upon the agreement type that suits you best.

The financial advantages to implementing a biomass system is apparent, with the significant reduction in heating costs, however the initial investment can be substantial. HAF’s finance solution can help by reducing that initial investment and spreading the cost over an agreed period. This can be obtained via a biomass boiler asset finance agreement which is tax efficient and helps support cash flow.

Please give us a call today or send an enquiry form through for a free, no obligation finance quotation.

Biomass Boilers

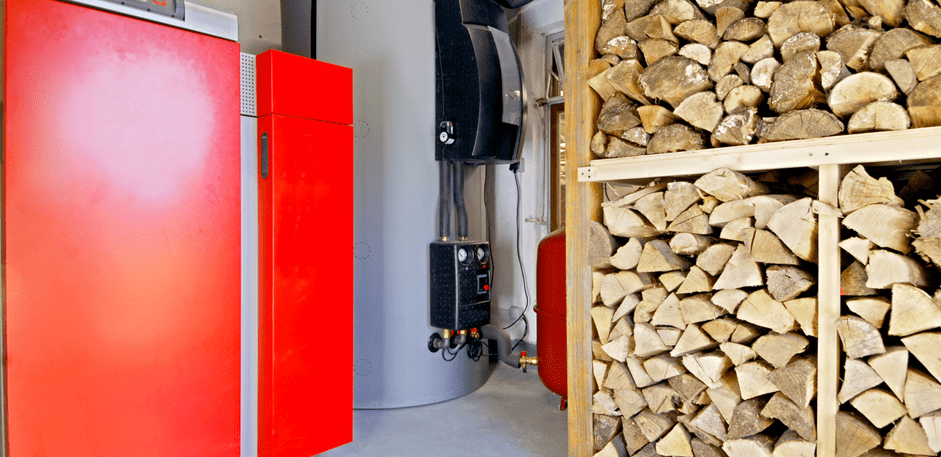

Thousands of businesses across the UK are now thinking of ways to become more environmentally friendly but also use this as a tool to reduce ongoing costs. HAF are seeing an increase in businesses financing electric vehicles, solar panels and also biomass boilers. A biomass boiler is an alternative energy solution to a traditional boiler. Biomass is organic material derived from plants and animals. Burning these biological materials in a biomass boiler provides a renewable and sustainable source of heat. Biomass boilers work in a similar manner as conventional ones, where water enters to be heated up before circulating back outwards through pipes within your building’s structure to produce heat.

There are three main types of biomass boilers; low temperature hot water (LTHW), high temperature hot water (HTHW) and steam. LTHW is the most popular biomass boiler and can be used for commercial properties such as offices, restaurants, hotels and district heating systems where multiple buildings are connected to the same boiler.

When switching from a traditional fossil fuel source such as oil to a biomass boiler, you could expect to see fuel savings from anywhere between 30% to 50%, or even up to 80% if biomass is replacing electric for heating. If this is something you are considering, please get in touch with us here at HAF. We can discuss how our biomass boiler finance solutions can help you.

Why Use HAF?

As industry leaders in the asset finance industry, we have a dedicated team that specialise in hard asset finance. Partnering alongside suppliers and providing direct finance to customers. We can provide leading rates, professional advice and connections to some of the best suppliers and manufacturers of equipment and vehicles. Saving you time and effort by delivering an all-in-one solution. Perfect for any business looking to acquire hard assets in the most affordable way possible.

The sectors we specialise in include commercial vehicles, manufacturing equipment, plant equipment, machinery, construction vehicles and agricultural machinery/vehicles.

Financing hard assets provides finance companies with good security as the assets tend to retain value for many years, even at the end of their lease. This combined with our access to a diverse portfolio of funders means we can provide you a bespoke and affordable finance option.

Key points

- We can source your vehicle

-

Offer a range of flexible

finance options - Provide industry leading rates

- Both new and used vehicles

-

Offer years of industry

experience

Benefits of Biomass Boiler Finance

Asset finance is most commonly used to acquire hard assets. A hard asset is a tangible/physical asset with fundamental value that are normally held for the long term. Like recovery trucks they are often key to the businesses operations but are expensive in value. These are two of the key reasons why most businesses look to use a hard asset finance facility. There are also a range of benefits that come with this option:

Protect Cash Flow

Keep cash in the business and invest in areas that will produce a return on investment. Obtain the vehicle that is necessary for your business with little to no upfront cost.

Fixed Repayments

Perfect for financial planning and selecting a finance package that is affordable for your business.

No Large Upfront Cost

No need to invest large sums upfront, however this is an option if you wish to reduce monthly payments.

Quick Access

If you need a recovery truck urgently but don’t have the immediate cash available, finance allows you to obtain the asset immediately without having to wait for the cash reserves.

Access to Higher Spec Vehicles

No need to compromise on the vehicle you select. The difference in a newer or higher spec vehicle can often be a very small increase in monthly payments.

HAF Finance

Here we have the four agreement types used for recovery truck finance and all hard assets. Here at HAF, we will guide you through all options and help you select the most suitable for your business.

Finance Options

Hire Purchase

Hire Purchase (HP) are monthly rental instalments where at the end of the term you have the option to purchase the asset outright or simply return it. Payments can be structured to align with your cash flow which could mean a small upfront payment or larger to reduce monthly payments.

Finance Lease

A finance lease is a leasing agreement which involves renting the asset over an agreed period of 1-5 years. A popular method due to the significant tax advantages. At the end of the agreement, you have four options: Hand the asset back to us at HAF, purchase the asset outright, continue paying the monthly payments or take out a new lease.

Operating Lease

An operating lease is an agreement to use and operate an asset without the transfer of ownership. Often used for high value assets, the rental is at an agreed rate and time period. The rental will not cover the full cost of the asset, therefore at the end of the agreement a residual value is offered by the funder which allows you to buy the asset minus the lease rentals paid so far.

Business Contract Hire

Business contract hire is a popular finance option used for company cars. The vehicle is leased over an agreed period from 2-5 years. At the end of the agreement, the vehicle is handed back to the finance company. A simple agreement often used for brand new vehicles, sometimes used with no upfront fee just monthly instalments.